The main weakness of an automated trading system

Modern technologies actively influence all spheres of our life. In medicine, there are more and more developments that help identify diseases. In finance, new tools are emerging to help us make transactions easier. And if you are a trader, then a separate computer program has been created for you.

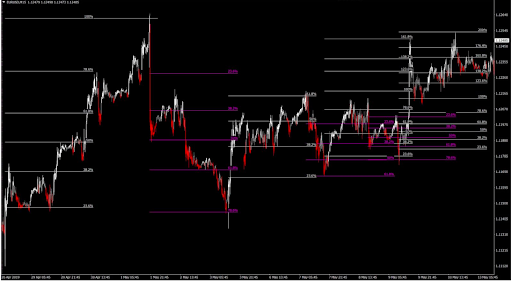

We are talking about automated trading software. Let’s figure out what it is. This is a special development that helps traders control the financial market. With its help, you can analyze and choose the ideal moment for making transactions. As a rule, it functions on mathematical algorithms, as well as special strategies. Traders can independently adjust the work and select the ideal strategy for themselves. If you are interested in this topic, then you can find out in more detail how to build automated trading system and how much it will cost.

What makes an automated trading system unique?

The main feature of this system is that it independently performs trading operations in the market. A trader does not need to constantly sit and monitor the market, wait for the right moment, or spend time on it. Everything is done automatically by the system. Naturally, you will need to keep an eye on how the ATS is operating, but this doesn’t take much time.

As mentioned earlier, you choose the strategy yourself. It can be either more aggressive or less. It all depends on your tactics, which you are used to following in the market. The trader only needs to choose the right strategy, all trading operations will be performed automatically. You can also choose when the strategy should work. Every time of day or night is possible. Thus, you will not miss the best moments for transactions.

However, ATS is not a one size fits all tool. You should first learn as much as you can about this development, including its functions and characteristics. In addition, to use it effectively, you need certain knowledge and skills. Thus, not everything is as straightforward as it might appear at first.

Automated Trading Fraud

One of the main disadvantages of automated trading is that it can be difficult to avoid scams and fraudulent vendors. Since many traders are looking for ways to invest their money automatically, many companies take advantage of this by offering high-yield investment opportunities that turn out to be scams. Unfortunately, there are many such situations. Therefore, you need to be vigilant so as not to encounter such situations.

To protect yourself from such companies, it is important to do your research before working with any auto trading provider. Some tips to avoid scams:

- Research and confirm the company or service you plan to work with. You can often find online testimonials from other traders who have used the automated trading system in question, as well as information about the provider and its licensing or regulatory status. See reviews from different sources, because they can also be faked;

- Be wary of high-yield investment opportunities that seem too good to be true. Automated trading systems can make great profits, but if an offer seems too good to be true, it may not be the best reason;

- Work only with proven suppliers with extensive experience. By choosing a well-established and reliable provider, you can be more confident that your automated trading system will help you achieve your investment goals without being a scam.

Overall, if you take the time to carefully research and select an auto trading provider, you will be able to minimize the risks of trading with this type of system and maximize your chances of success. Before starting work with such tools, learn as much as possible about them and understand how to work with them. It is not so simple.